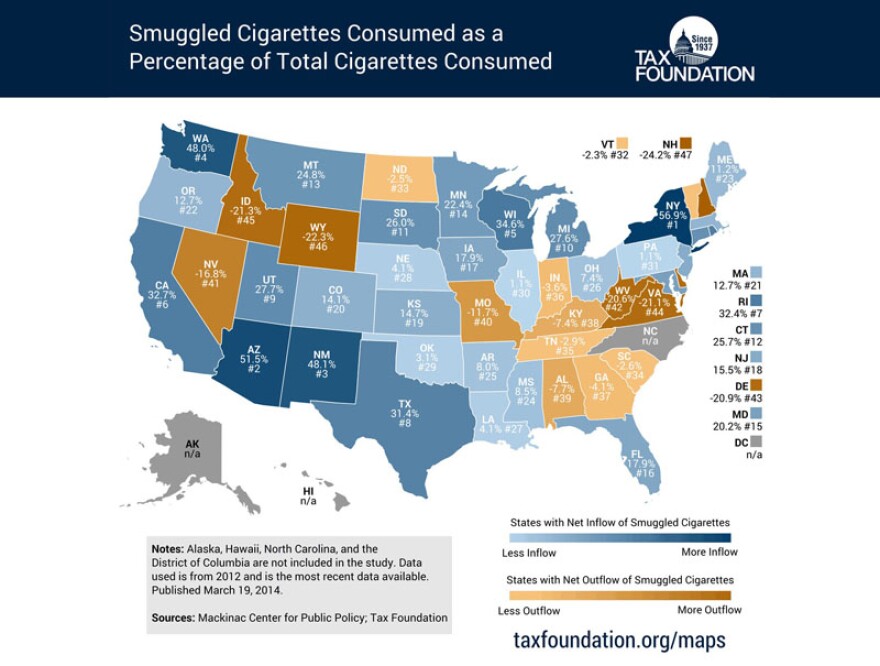

Nearly half of the cigarettes smoked in Washington went untaxed by the state according to an estimate from a new study by two think tanks.

The non-partisan Tax Foundation and Mackinac Center for Public Policy argue differential tax rates create the incentive for black market sales or simple bargain shopping across state lines by individuals.

The study compared actual legal sales in a state against the level you would expect to see based on its smoking rate to come up with a smuggling estimate.

The study pegs low-tax Idaho as a major source of smuggled cigarettes. Idaho's tobacco tax is less than half of Oregon's and one fifth of Washington's.

Mackinac Center director of fiscal policy Michael LaFaive says the most obvious solution is to roll back taxes in the high tax states.

"That has not been met with a great deal of applause except by a few legislators," he says. "We recognize that."

Washington State's Department of Revenue calculates the smuggling rate slightly differently because it considers sales from tribal smokeshops to be legal in most cases where the tribe collects taxes. But even taking that approach still yields a tax evasion rate of 35 percent.

Oregon, with its below average excise tax, has a cigarette tax evasion rate of 12.7 percent according to the think tank study.

Washington has the sixth highest tobacco tax in the country at $3.025 per 20-cigarette pack. Idaho has one of the lowest cigarette tax rates in the nation at 57 cents per pack. The Tax Foundation study estimated that more than 20 percent of cigarettes sold in Idaho in 2012 were smoked out of state.

The study also found that illegal imports into Oregon decreased between 2006 and 2012. Oregon's cigarette tax remained stable during that period, while some other Western states raised theirs. In 2013, the Oregon Legislature voted to increase its excise tax from $1.18 to $1.31 per pack which took Oregon closer to the national average of $1.53 per pack.